Former Fed Chair Bernanke, Current Fed Governor Cook to Keynote Annual JRCPPF Conference

Former Federal Reserve Board Chair Ben S. Bernanke and current Fed Governor Lisa D. Cook will deliver keynote addresses at the 13th annual conference of the Julis-Rabinowitz Center for Public Policy & Finance (JRCPPF).

This year’s conference, “Macrofinance in the Long Run: New Insights on the Global Economy(external link),” will be held on campus, in the Julis Romo Rabinowitz Building, on February 22 and 23.

Researchers, policy experts, and market practitioners from around the world will explore significant questions for long-run macrofinance, including the recent inflationary shocks, monetary policy responses, and global economic impacts.

According to Pallavi Nuka, JRCPPF’s associate director, the conference will feature exciting new research by a host of young economists working at the forefront of empirical macrofinance.

“An overarching theme of the agenda is to explore the gap between benchmark macroeconomic models and the historical trends over the last half-century, highlighting the long-run policy implications,” Nuka said.

Fed Governor Lisa D. Cook

Fed Governor Lisa D. Cook

The gathering begins at 5 p.m. on February 22 with a conversation between Cook and Giovanni L. Violante, the Theodore A. Wells ’29 Professor of Economics. Cook was appointed to the Fed’s Board of Governors in May 2022. Prior to that, she taught at Michigan State University and Harvard University’s Kennedy School of Government, and served at the National Bureau of Economic Research, the Council of Economic Advisers, and the U.S. Department of the Treasury.

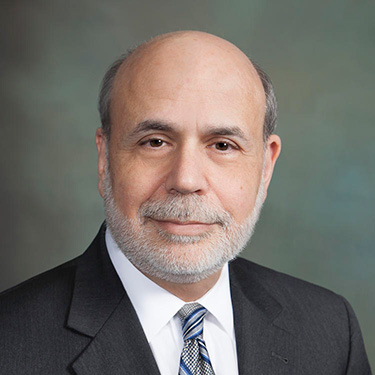

The conference continues on Friday, February 23, from 9 a.m. to 4 p.m., with sessions on supply-side macroeconomic policy and long-run structural challenges, as well as a second keynote with Bernanke, currently a distinguished senior fellow in economic studies at the Brookings Institution and former chair of the Federal Reserve.

Former Federal Reserve Board Chair Ben S. Bernanke

Former Federal Reserve Board Chair Ben S. Bernanke

Bernanke, a winner of the Nobel Prize in Economic Sciences, served an eight-year tenure as chair of the Fed’s Board of Governors of the Federal Reserve System under two presidents as well as an additional three years as a member of the Board of Governors, and chaired the President’s Council of Economic Advisers. For 17 years, he was a professor of economics and public affairs at SPIA.

Among the topics to be addressed is the tightening cycle that began in 2022 after several decades characterized by extremely low interest rates, high debt loads, and extremely high asset valuations, said conference chair Atif Mian, the John H. Laporte ’67 Professor of Economics and JRCPPF’s director.

"How does a system accustomed to very low rates and hence high debt and valuations respond to rising rates?” Mian said. “The question can be looked at from the demand side, the supply side, or distributionally. We can also look at this question from a global and developing country perspective. And there’s the additional question of whether and when ‘global’ finance has been useful for developing countries.”

In addition, speakers will address how structural “imbalances” arise and how they affect interest rates and financial markets.

“One dimension here is cross-border for the global imbalances question,” Mian said, “and the other dimension is inequality for the internal imbalances question.”

While free and open to the public, registration is required to attend(external link). For those unable to attend the conference in person, all the sessions will be livestreamed here(external link), and the videos will be available on the JRCPPF YouTube channel(external link).

JRCPPF’s previous annual conferences have focused on net-zero finance, macroeconomic policy in Africa, development finance, radical markets, the future of globalization, China’s economy and financial system, the European crisis, recovery after the Great Recession, consumption and finance, inequality and long-run growth, and financial innovation in the macroeconomy. Programs, presentation slides, and videos from all these events are available on the JRCPPF website(external link).